Thought Leadership

Capstone Legal is quoted regularly by leading newspapers and journals on a diverse range of legal issues.

“The Supreme Court hearing a petition filed by Amazon has barred the NCLT from issuing any orders in the $3.4 billion deal between Reliance Industries and Future Group. This has further deepened the legal dispute between Amazon and Future Group”

— Quoted in ABP Live on 23 FEBRUARY 2021.

“There is no order by any court stopping the NCLT from taking a decision on the Future-Reliance deal. Moreover, Sebi and CCI have already approved the deal while considering various Indian applicable laws.”

— Quoted in The Economic Times on 18 FEBRUARY 2021.

“The Tata Trusts were formed even before the Income Tax Act and the Companies Act were enacted. Corporate Governance has evolved substantially in India after amendments being brought in various laws keeping in mind the ever evolving global developments. A change in the governance structure and audit controls are a welcome step to ensure effective corporate governance. This would go a long way in instilling confidence among retail and institutional investors as well.”

— Quoted in The Economic Times on 16 FEBRUARY 2021.

TVS Group approaches National Company Law Tribunal for business recast.

“Special Leave Petition in Supreme Court against an interim order is most likely to be entertained only if raises a substantial question of law”

““Firstly the award should have been declared as enforceable and deemed to be a decree of a court. Secondly, there should be bad faith, not just indifference to satisfy the decree of the court””

“Enforcement can be sought by filing a civil suit or by filing an application under Section 9 of the Arbitration and Conciliation Act. Along with a suit, an application seeking interim injunction can also be made”

— Quoted in THE ECONOMIC TIMES on 25 JANUARY 2021.

“If there is a challenge to a mere observation, then the proper course is to file a review application or application for rectification before the same court which passed the order in question,” said Ashish K Singh, managing partner of law firm Capstone Legal. “An appeal in which a substantive portion of the order has not been challenged is unlikely to succeed.”

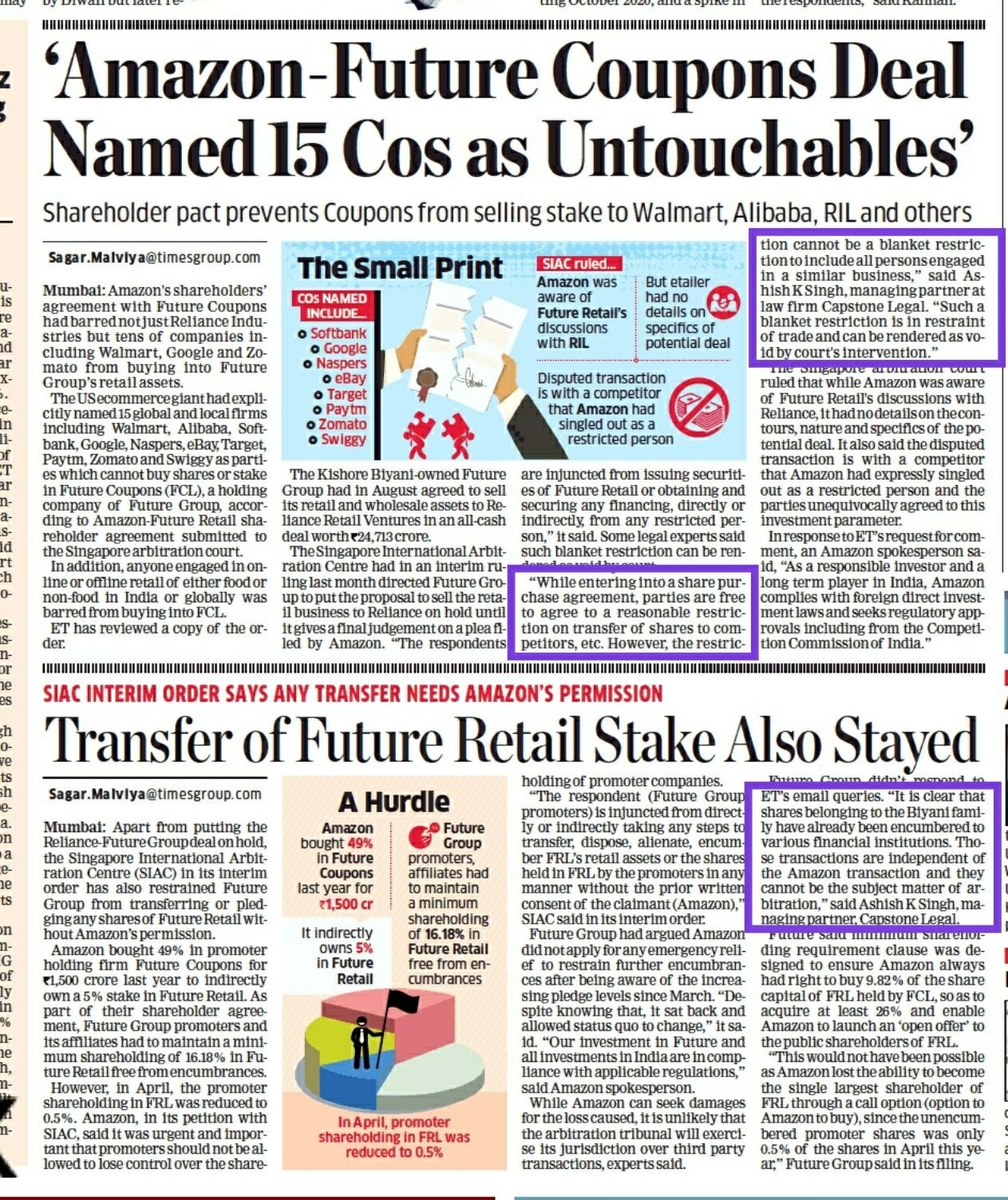

“The reliefs did not include setting aside of the arbitral award and therefore any observation by the court on the validity of the award is merely an obiter dicta, i.e., a passing observation”

“The interim relief to Future Retail has been expressly denied. But, while giving the reasoning, the Delhi High Court has expressed an opinion over issues which were not a subject matter of the suit before the court. These observations can therefore be of some persuasive value but in any case, they are not binding”

“The subject matter of the suit and relief claimed was not related to the enforceability of the emergency award given by SIAC. Therefore, it cannot be said that this judgement of the Delhi High Court has vitiated the basis of this arbitral award. At best, for the appropriate court, this order will be of persuasive value”

— Quoted in THE ECONOMIC TIMES on 24 DECEMBER 2020.

“While entering into a share purchase agreement, the parties are free to agree to a reasonable restriction on transfer of shares to competitors, etc. However, the restriction cannot be a blanket restriction to include all persons engaged in a similar business”

“The proposed transaction was primarily for the purpose of strengthening the business of FCL. It is a settled proposition that as a regulator, CCI can revoke any order passed, which is based on a misinterpretation or suppression of facts ”

“In case any such obligation is disclosed during the due diligence exercise, it has a direct bearing on the valuation of shares. It is safe to assume that while making an offer for purchase of Future’s shares, Reliance must have taken into consideration a proposed dispute which may arise with Amazon”

“An application can be filed under Section 9 of the Arbitration and Conciliation Act seeking interim protection, given the fact that final arbitration is currently pending in Singapore. In the present case, an application is required to be filed in Bombay High Court, should Amazon choose to pursue it”

— Quoted in THE ECONOMIC TIMES on 27 OCTOBER 2020.